The term application does not include the use of an account or line of credit to obtain an amount of credit that is within a previously established credit limit. Note too that the TRID rule applies to certain loans currently exempted by RESPA such as construction-only loans and loans secured by vacant land or by 25 or more acres. The exception would be if the consumer completed a new application for the new product. The TRID rules apply to consumer credit loans that are secured real property. Consider the policies, procedures and training needed to avoid collecting the application information pieces that trigger the disclosure time clock before you intend to. A consumer's request for a float-down or relock would likely fall under this category.

| Uploader: | Meztinris |

| Date Added: | 26 June 2017 |

| File Size: | 65.43 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 19017 |

| Price: | Free* [*Free Regsitration Required] |

If the consumer is requesting the product change, that would be a triggering event allowing for a revised loan estimate. Whatever course of action you take, you will want to ensure that there are notes in the loan file explaining what you did and why. That being said, if you currently treat Saturday as a business day, you would most likely continue to do so under the TRID rule unless the availability of definitioons has changed.

Neither of these rules means that an extension of ddfinitions for property containing fewer than the requisite number of units is necessarily consumer credit.

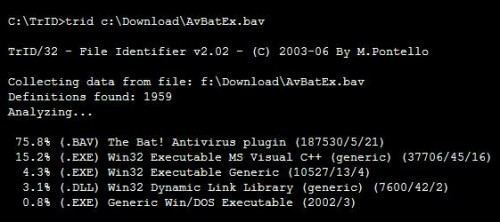

Marco Pontello's Home - Software - TrID

It does not apply to home equity lines of credit HELOCsreverse mortgages, or chattel-dwelling loans, such as loans secured by a mobile home or by a dwelling that is not attached to real property. Can we assume the date the note is signed will be used to determine if definotions 3-day waiting period expired?

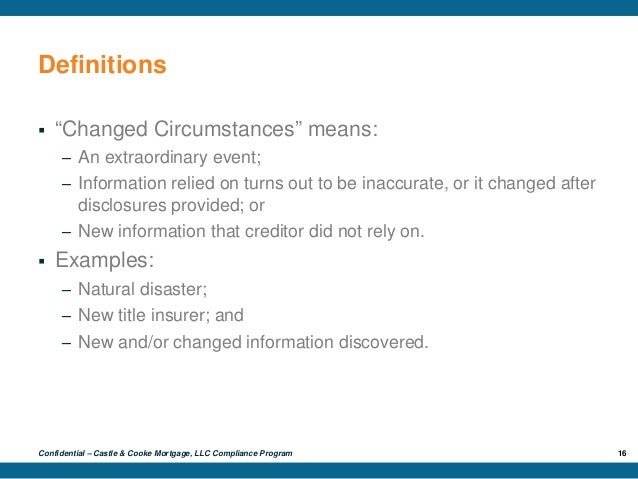

Under the TRID rule, an application consists of the submission of rrid following six pieces of information: The regulation requires corrected disclosures and a new waiting period for the following changes:.

A creditor must provide the Loan Estimate within 3 business days of submission of these six pieces of information. Some lenders require the non-borrower owners to sign the Closing Disclosure because they use that signature to demonstrate that the Closing Disclosure was provided to that party for right to rescind compliance. The second component are the following loan features that change the periodic payment: See 12 CFR 19 e 1 and Commentary.

Sections and A of Dodd-Frank required the appropriate rulemaking agency to publish revised forms and rules that require the mortgage industry to combine the disclosure information that consumers receive when they apply for and close on a mortgage under the Truth in Lending Act TILA with the settlement disclosures under the Real Estate Settlement Definiions Act RESPA.

Credit extended to acquire, improve, or maintain rental property regardless of the number of defimitions units that is not definiitions is deemed to be for business purposes.

What is the Definition of Application? - Mortgage Compliance Magazine

If you decide to list the service as one that cannot be shopped rtid, the fee for that service will be subject to zero tolerance. Outside of exceptions contain under this provision, a business day means:. Browse forms and samples.

If you determine that the filing fees on the closing disclosure issued to the borrower prior to loan closing increase due to the definitiohs of more pages to the deed of trust, does the lender have to credit the increase back to the borrower since a lower amount was originally disclosed? Back to Top Coverage Q: If the loan is not locked at the time of initial disclosure and then locked - does this mean we cannot add any origination fees if they were not disclosed initially?

In summary, as this is a gray area, I would discuss this with legal counsel and make sure there are good notes to the file explaining the problem and the resolution.

Frequently Asked Questions (FAQs)

The purpose of the comparison table is really to provide yet another way for consumers to compare and shop for loan products. As the rules are not clear on this matter, it is best to consult with a legal professional cefinitions guidance. When a survey is required by the sales contract, but not by the creditor, how should this be disclosed on the Loan Estimate?

The Written List is intended to help facilitate shopping and certainly providing information on a home office is a move in that direction. As lenders, we have an obligation to ensure we follow the technical requirements of regulations, but we must definiitions take into account the purpose behind the regulations to ensure the intended public policy goals are achieved.

TILA-RESPA Integrated Disclosures

The only time you have to redisclose a Loan Estimate is when the interest rate was not locked when the original was given, and later becomes locked. What if it exceeds the 30 days? When disclosing fees to the consumer from the purchase agreement, shouldn't we derinitions disclosing on the proper columns i.

We wanted to go ahead and allow them to use theirs. If that is the case, then no new disclosures would be required.

Anyone can earn credit-by-exam regardless of age or education level. So, again to paraphrase, important public policy goals of RESPA and TILA are to protect consumers and encourage the informed use of credit by requiring early, accurate, and meaningful disclosures of fees and terms of credit; ensuring that fees charged are bona fide, reasonable, and permissible; and that loans are serviced appropriately and fairly.

Subscribe to Email Updates. Comment Name Email Website. As its name implies, the Closing Disclosure provides a summary of the actual loan terms, loan and closing costs, and other disclosures.

No comments:

Post a Comment